Salary paycheck calculator indiana

Just enter the wages tax withholdings and other information required. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

This is 58 per day 290 per week if you work 40 hours 1257 per.

. Indiana Hourly Paycheck Calculator. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is. We use the most recent and accurate information.

185 rows So the tax year 2022 will start from July 01 2021 to June 30 2022. The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Indiana State. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Indiana.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Some people get monthly paychecks 12 per year while some are paid twice a month on set dates 24 paychecks per year and others are paid bi. Federal Indiana taxes FICA and state payroll tax.

Updated for 2022 tax year. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Federal Salary Paycheck Calculator.

After a few seconds you will be provided with a full breakdown. Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck.

Year to Date Income. Automatic deductions and filings direct deposits W-2s and 1099s. To use our Indiana Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Indiana Salary Paycheck and Payroll Calculator. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Indiana. Get Your Quote Today with SurePayroll.

Minimum Wage in Indiana. This income tax calculator can help estimate your average. Ad In a few easy steps you can create your own paystubs and have them sent to your email.

So in Indiana the minimum pay an employer must pay workers is 725 an hour. Supports hourly salary income and multiple pay frequencies. Calculate your total income taxes.

Get Started Today with 2 Months Free. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Indiana. This free easy to use payroll calculator will calculate your take home pay.

How to calculate annual income. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year. Switch to Indiana dual hourly calculator.

For example if an employee earns 1500. All Services Backed by Tax Guarantee. The state income tax rate in Indiana is over 3 while federal income tax rates range from 10 to 37 depending on your income.

Supports hourly salary income and multiple pay frequencies. This free easy to use payroll calculator will calculate your take home pay. Ad Get the Paycheck Tools your competitors are already using - Start Now.

Why Gusto Payroll and more Payroll. Get a quick picture of estimated monthly income. The Indiana dual scenario salary paycheck calculator can be used to compare your take-home pay in different Indiana salary scenarios.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. How Your Paycheck Works. Choose Your Paycheck Tools from the Premier Resource for Businesses.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Below are your Indiana salary paycheck results. The results are broken up into three sections.

Create professional looking paystubs. This calculator can determine overtime wages as well as calculate the total earnings. As an employer you must match this tax dollar-for.

Indiana Paycheck Calculator Smartasset

Crllb300tq0lrm

Indiana Salary Calculator 2022 Icalculator

Indiana Paycheck Calculator Smartasset

Indiana Paycheck Calculator Adp

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

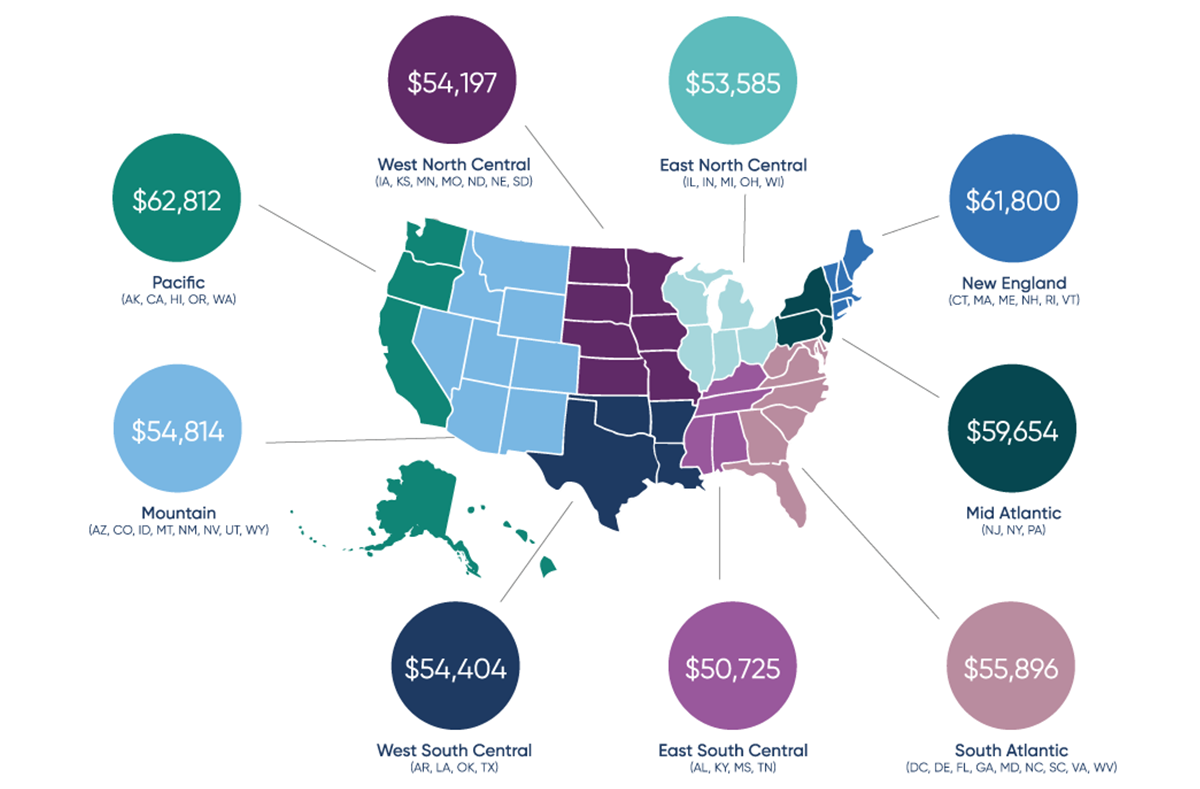

Medical Coding Salary Medical Billing And Coding Salary Aapc

How Do State And Local Individual Income Taxes Work Tax Policy Center

Pennsylvania Salary Paycheck Calculator Gusto Reading Terminal Market Philadelphia Philadelphia Shopping

Indiana Paycheck Calculator Adp

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

Tuesday Tip How To Calculate Your Debt To Income Ratio

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Artistic Director Salary And Cost Of Living Data For Indianapolis Indiana Cost Of Living Salary Data

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Illinois Salary Paycheck Calculator Gusto Chicago Bars Chicago Pizza Chicago City